Agendas & Minutes

January 16, 2024

January 9, 2024

Image

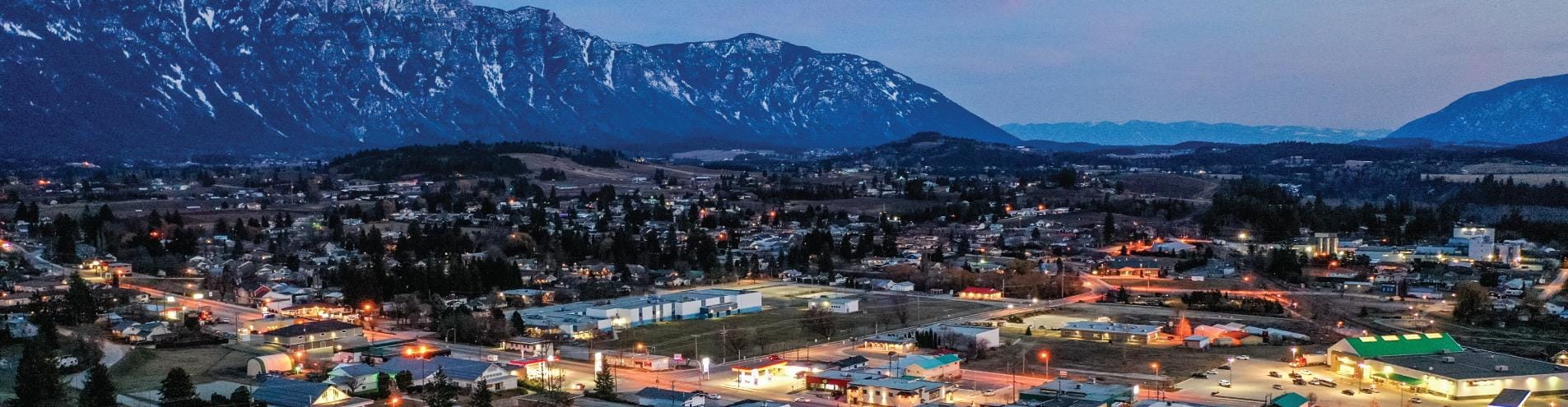

The Town of Creston

Residents enjoy a mild climate, stunning scenery and small town living at its best.

Population of 5,583

4.1% increase from 2016

$994,000 in Property Assessments

26.5% increase from 2020

540 Business Licences

Issued in 2021

Connect With Us

Follow us on Social Media

Stay up to date on Town of Creston news by following our social media accounts!

Let’s Talk Creston

Creston’s online engagement website. Contributing your thoughts, ideas, and feedback has never been easier.

Notify Me

Subscribe to receive community updates or manage your subscriptions.